The key to whether the Bank of Japan will raise interest rates in April is the outcome of the spring fight.

At the first monetary policy meeting in 2024, the Bank of Japan remained "inactive" and kept the yield curve control (YCC) and negative interest rate policy unchanged, which basically met market expectations. At the same time, the Bank of Japan lowered its core CPI forecast for fiscal year 2024 and GDP forecast for 2023.

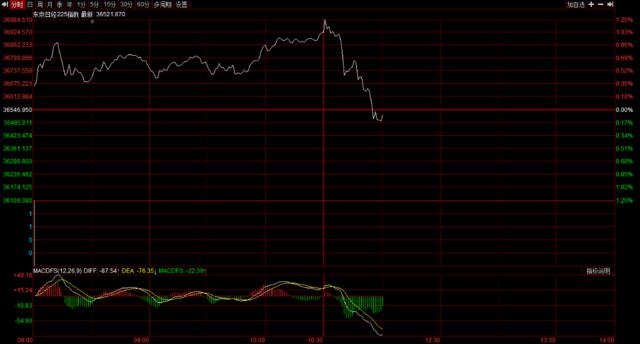

Japanese stock exchange staged a "roller coaster". After a short-term diving, the yen rose, while the stock market showed the opposite trend.

At the afternoon meeting (for more details, please refer to the calendar applet), the governor of the Bank of Japan, Kazuo Ueda, said that the uncertainty of the price outlook is still high, and even if the negative interest rate ends, the relaxed policy environment will continue.

However, he also pointed out that the certainty of the central bank’s 2% sustained inflation target is gradually rising, saying that it will carefully evaluate the data including the spring labor negotiations. Some analysts predict that labor negotiations in spring will help to form a virtuous circle of wages/inflation, and the possibility of the Bank of Japan raising interest rates in April is as high as 90%.

The Bank of Japan stayed put.

On the morning of January 23rd, the Bank of Japan issued a resolution statement:

The deposit interest rate remains unchanged at -0.1%;

The yield target of 10-year treasury bonds remains around 0%, and the fluctuation of 1% is still regarded as the reference line;

Will buy "necessary amount, but no upper limit" of Japanese debt.

The wording of the Bank of Japan’s policy guidelines has not changed, indicating that it will "patiently" adhere to monetary easing until the inflation rate reaches 2%.

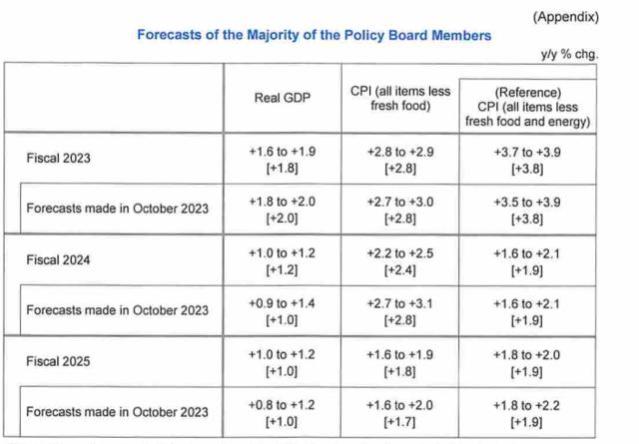

At the same time, the Bank of Japan released the latest economic forecast and inflation forecast:

It is estimated that the CPI (excluding fresh food) in fiscal year 2023 will be 2.8%, which is the same as previously expected;

The CPI (excluding fresh food) in fiscal year 2024 is expected to be lowered from 2.8% in October to 2.4%;

Raise the CPI (excluding fresh food) in fiscal year 2025 from 1.7% in October to 1.8%;

It is estimated that the CPI (excluding fresh food and energy), known as the "core in the core", will be 3.8% in FY 2023, which is the same as previously expected.

It is estimated that the CPI (excluding fresh food and energy) will be 1.9% in FY 2024, which is the same as previously expected.

It is estimated that the CPI (excluding fresh food and energy) will be 1.9% in FY 2025, which is the same as previously expected.

Reduce the GDP forecast for fiscal year 2023 from 2% to 1.8%;

Raise the GDP growth forecast for fiscal year 2024 from 1.0% to 1.2%;

Maintain the GDP forecast for fiscal year 2025 at 1%.

This revision predicts that by fiscal year 2024, Japan’s CPI inflation (excluding fresh food) will be higher than the Bank of Japan’s target for three consecutive years. The Bank of Japan insists that unless the wage growth momentum accelerates, the inflation target will not be achieved stably and sustainably.

After the announcement of the monetary policy resolution, the yen fell to 0.2% against the US dollar, and then the yen continued to rise. USD/JPY is now quoted at 147.95 yen, down 0.11% in the day.

The Nikkei 225 index once rose by 1.2%, but then fell, and the increase of the Dongzheng index narrowed to 0.3%, after rising by 0.8%.

Japanese 10-year government bond futures rose 20 points to 147.10.

Governor of the Bank of Japan: Even if negative interest rates are ended, the relaxed environment will continue.

On Tuesday, 23rd, Bank of Japan Governor Kazuo Ueda said at the January monetary policy press conference that the uncertainty of the price outlook is still high, and he will not hesitate to increase the easing policy if necessary.

According to the current economic forecast, even if we end the negative interest rate, the monetary environment may still be very loose. It is uncertain how long the easing policy will last after the end of negative interest rates.

Ueda Kazuo said that import-driven inflation has peaked, and if the price target is in sight, we will consider whether to maintain negative interest rates, but it is still difficult to say how far it is from withdrawing from the negative interest rate policy.

However, he also pointed out that the certainty of achieving the central bank’s inflation target is gradually rising, service prices are rising moderately, and the progress of forming a virtuous circle of inflation is still being observed, and the ripple effect of wage increase is spreading to prices little by little.

We still believe that service inflation is gradually accelerating, which has become a trend. The focus in the future will be whether wage increases will affect prices, especially service prices.

When asked whether the Bank of Japan will still maintain YCC (yield curve control policy) or buy a large number of bonds after ending negative interest rates, Ueda Kazuo said:

We hope to avoid major interference with the continuity of policies.

At the same time as Ueda spoke, the yen expanded its gains, and the yen rose by about 20 points against the US dollar in the short term.

Ueda Kazuo also said that the central bank has not fully grasped the impact of the earthquake on the economy, and a certain amount of information is available before the March meeting. The central bank will pay close attention to the impact of the earthquake on the economy.

Will interest rates be raised in April? The key lies in the result of spring fighting.

Ueda Kazuo also said that there will be more data at the policy meeting in April than at the policy meeting in March. He said that the trade unions demanded a pay increase in Japan’s annual spring labor negotiations, and the central bank would carefully evaluate the data including the spring labor negotiations.

Many enterprises have made decisions on salary in advance, but they are not sure about the extent and scope of salary increase.

Policy decisions can be made without all the wage data of small enterprises, and the results of labor negotiations in large enterprises will also affect the results of small enterprises. Rising service prices may push up wages.

Earlier, a former senior official of the Bank of Japan predicted that the result of this spring fight is expected to increase wages by 4%. Wall Street believes that this will help to form a virtuous circle of wages/inflation, and the reasons for the Bank of Japan to raise interest rates at the April meeting are more and more sufficient. Rengo, the trade union federation, will announce the preliminary results on March 15th.

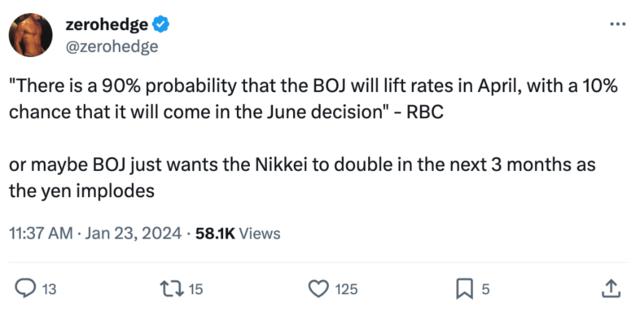

Alvin Tan, head of Asian foreign exchange strategy in capital markets of Royal Bank of Singapore, predicts that the possibility of the Bank of Japan raising interest rates in April is still as high as 90%, and the possibility of raising interest rates in June is only about 10%. In this regard, zerohedge, a well-known financial blog, said that perhaps the Bank of Japan hopes to wait until the Nikkei index doubles in the next three months, when the yen will explode.

This article does not constitute personal investment advice, and does not represent an opinion. The market is risky, so you need to be cautious when investing. Please make independent judgments and decisions.

Original title: "The Bank of Japan" does not move, and whether to raise interest rates in April depends on the outcome of the spring fight. "

Read the original text